Serviced accommodation is one of the most talked about strategies in UK property right now — and for good reason.

Done properly, it can outperform traditional buy to let on cash flow, flexibility, and tax efficiency. Done badly, it can drain time, money, and energy faster than almost any other property model.

This guide cuts through the hype.

You’ll learn what serviced accommodation actually is, why investors are moving away from buy to let, and where SA genuinely works — and where it doesn’t.

What Is Serviced Accommodation?

Serviced accommodation (SA) refers to fully furnished properties let on a short term or medium term basis, typically from one night up to several months.

They combine hotel style convenience with the space and privacy of a residential home.

Serviced accommodation can include:

• Apartments

• Houses

• Studios

• Purpose built or converted blocks

Properties are marketed on platforms such as Airbnb, Booking.com, Expedia, and through direct corporate booking channels.

The key difference: SA is operated as a business, not a passive rental.

Key Features of Serviced Accommodation

Most professionally run SA properties share the following characteristics:

• Fully furnished and equipped for short stays

• Utilities, council tax, Wi Fi, and bills included

• Flexible nightly, weekly, or monthly pricing

• Professional cleaning between guests

• Self check in systems (digital locks or key safes)

This operational setup allows pricing and strategy to adapt quickly to market conditions.

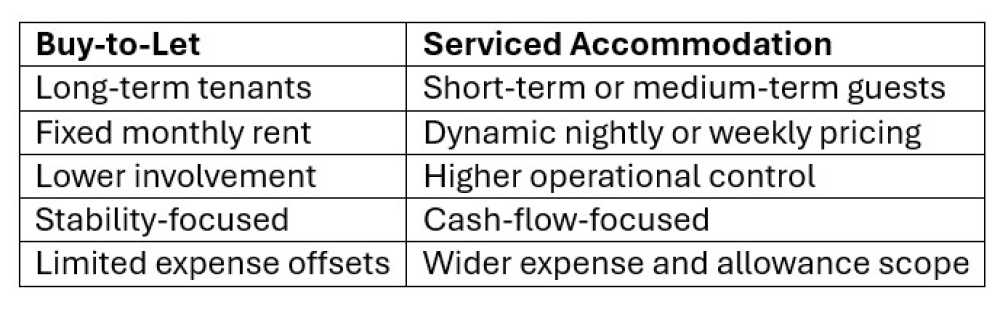

Serviced Accommodation vs Buy to Let (The Real Difference)

Why Investors Are Shifting Toward Serviced Accommodation

1. Higher Cash Flow (When Numbers Stack Up)

Because SA is priced per night rather than per month, well located properties can generate significantly higher gross income than traditional rentals.

In many UK markets, 70–80% occupancy at sensible nightly rates can outperform a full month of AST rent — even after cleaning, management, and platform fees.

The mistake many investors make is assuming 100% occupancy. Professionals underwrite conservatively.

2. Demand From Multiple Markets

Serviced accommodation doesn’t rely on a single tenant profile. Demand typically comes from:

• Business travellers

• Contractors and project workers

• Relocation clients

• Insurance and emergency stays

• NHS and local authority placements

• Tourists and visiting family

This diversity makes SA more resilient than most people realise — when marketed correctly.

3. Flexibility Traditional Rentals Don’t Offer

SA allows investors to:

• Adjust pricing daily

• Pivot between short term and medium term stays

• Block dates for personal use

• Sell with vacant possession

This flexibility becomes especially valuable during regulatory changes or economic uncertainty.

4. Tax Treatment and Structuring Advantages

Serviced accommodation is often treated as a trading business rather than passive investment, which can allow:

• Broader expense deductions

• Capital allowances on furniture and fixtures

• Different lending and ownership structures

• Potential VAT planning (where applicable)

Always seek specialist tax advice — incorrect structuring is one of the most common SA mistakes.

Where Serviced Accommodation Fails (And Why This Matters)

Serviced accommodation is not a guaranteed win.

It commonly underperforms when:

• The location lacks year round demand

• Regulations or leases prohibit short term letting

• Investors overpay based on unrealistic income projections

• Operations are treated casually rather than professionally

• Finance and insurance are incorrectly structured

Understanding these risks is what separates sustainable portfolios from short lived ones.

Can You Get a Mortgage for Serviced Accommodation?

Yes — but this is where many investors go wrong.

Serviced accommodation sits between residential property and hospitality, meaning:

• Many high street lenders restrict or prohibit short term letting

• Standard buy to let mortgages may breach terms if used incorrectly

• Insurance and lender alignment is critical

Specialist lenders, however, do offer products designed specifically for SA operators.

Common Serviced Accommodation Finance Routes

Depending on the strategy and asset type, SA can be funded using:

• Specialist serviced accommodation mortgages

• Holiday let or short term let products

• Limited company lending

• Bridging finance for refurbishments or conversions

• Semi commercial or commercial mortgages for blocks

• Refinancing based on stabilised SA income

The correct route depends on:

• Length of stay model

• Property type

• Experience level

• Ownership structure

• Exit strategy

Why Specialist Advice Matters

Serviced accommodation finance is not plug and play.

Poor advice can lead to:

• Mortgage breaches

• Invalid insurance

• Forced refinancing

• Reduced borrowing capacity

Investors who treat finance as part of the strategy — not an afterthought — scale faster and with less risk.

How Sourced Financial Services Supports SA Investors

Sourced Financial Services works with investors using advanced property strategies, including serviced accommodation.

Their approach focuses on:

• Lender products aligned with SA usage

• Correct ownership and company structuring

• Portfolio level funding strategies

• Bridging and refinance solutions based on real SA income

Rather than forcing SA into unsuitable buy to let products, finance is structured to support long term scalability and compliance.

Is Serviced Accommodation Legal in the UK?

Yes — but compliance is location specific.

Key considerations include:

• Local planning requirements (particularly in London)

• Lease and title restrictions

• Mortgage and lender conditions

• Council short term letting rules

Professional operators carry out full due diligence before launch.

What Makes a Strong Serviced Accommodation Property?

Successful SA properties typically share:

• Proven local demand

• Strong transport links or accessibility

• Parking or easy arrival logistics

• Functional layouts for short stays

• High quality furnishing and presentation

• Robust systems for cleaning, pricing, and guest management

In SA, presentation directly impacts revenue.

Who Serviced Accommodation Is Best Suited For

SA works best for:

• Investors seeking higher cash flow

• Landlords affected by Section 24

• Entrepreneurs building active income streams

• Investors diversifying away from single strategy portfolios

• Those willing to treat property as a business

It can be hands on or fully managed — but it is never passive.

Final Thoughts: Is Serviced Accommodation Worth It?

Serviced accommodation isn’t a shortcut.

But when executed professionally — with the right location, numbers, systems, and finance — it can become a powerful pillar of a modern property portfolio.

For investors willing to move beyond traditional buy to let thinking, serviced accommodation offers something increasingly rare in today’s market:

Control, adaptability, and scalable cash flow.